does indiana have estate or inheritance tax

The District of Columbia moved in the. A federal estate tax is in effect as of 2021 but the exemption is significant.

Calculating Inheritance Tax Laws Com

Up to 25 cash back Indianas inheritance tax is imposed on certain people who inherit money from someone who was an Indiana resident or owned property real estate or other tangible property in the state.

. In general estates or beneficiaries of. Unlike neighboring Wisconsin Michigan Indiana and Missouri Illinois is one of just a dozen states that still have an estate or inheritance tax. Although some Indiana residents will have to pay federal estate taxes Indiana does not have its own inheritance or estate taxes.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are. Indiana Inheritance and Gift Tax.

Contact an Indianapolis Estate Planning Attorney For more information please join us for an upcoming FREE seminar. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. Whereas the estate of the deceased is liable for the estate tax beneficiaries pay the inheritance tax.

As a result of this weve included information on how the Indiana estate will manage your estate if you have a legal will as well as information on who is entitled to your property if you have an invalid will or none at all. While Federal Estate Tax is assessed on a decedents total combined asset value Indiana Inheritance Tax is a transfer tax assessed on each separate transfer. There is also a tax called the inheritance tax.

In fact the Indiana inheritance tax was retroactively repealed as of January 1st of 2013. Reform and repeal of estate and inheritance taxes have been very frequent in the last few years sometimes in states you might not expect. Inheritance tax applies to assets after they are passed on to a persons heirs.

The estate can then be reduced for miscellaneous costs to administer the estate legal and accounting fees and funeral related costs. Residents of New Jersey and Maryland have to contend with a state-level estate tax and a state-level inheritance tax in. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

Only 11 states still have an inheritance tax and Arkansas is not one of them. Are required to file an inheritance tax return Form IH-6 with the appropriate probate court if the value of transfers to any beneficiary is greater than the exemption allowed for that beneficiary. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation.

The transfer of a deceased individuals ownership interests in property including real estate and personal property may result in the imposition of inheritance tax. But make sure you do your tax planning. However if one of your beneficiaries lives in one of those 11 states then it could be good to incorporate protections for those taxes into your estate plan.

In general estates or beneficiaries of Indiana residents are required to file an inheritance tax return Form IH-6 if the value of transfers to any beneficiary is greater than the exemption allowed for that beneficiary. There is no inheritance tax in Indiana either. Just because you dont have an estate tax at the Indiana level you could find that you have it.

117 million increasing to 1206 million for deaths that occur in 2022. Eleven states have only an estate tax. While less than half of 1 of Americans will be assessed and estate tax the rate is as high as 40.

You should be notified by the estate if this is the case. 4 The federal government does not impose an inheritance tax. Tennessees estate tax will phase out fully in 2016.

Heres a quick summary of the new gift estate and inheritance changes that came along in 2022. It doesnt matter how large the entire estate is. Although the State of Indiana did once impose an inheritance tax the tax was repealed for deaths that occurred after 2012.

Indianas inheritance tax still applies. If you are curious about the six states that impose state-level estate taxes they are New Jersey Nebraska Iowa Kentucky Pennsylvania and Nebraska. Very few people now have to pay these taxes.

The tax is imposed on the recipient of the inheritance but many estate planning documents provide for the payment of the inheritance tax out of the decedents estate before assets are distributed. For individuals dying before January 1 2013. If you are a beneficiary you generally do not have to include inheritance on your income tax return.

In 2013 Indiana sped up the repeal of its inheritance tax retroactively to January 1 2013. Maryland and New York are in the process of phasing in new higher estate tax. Connecticut Hawaii Illinois Maine Massachusetts Minnesota New York Oregon Rhode Island Vermont and.

Indianas inheritance tax is imposed on certain people who inherit money from someone who was an indiana resident or owned property real estate or other tangible property in the state. So even if your assets are well below the exemption level they may increase overtime and you may find that you have a significant. Indiana has a very tax friendly state.

Despite the fact that certain Indiana citizens will be subject to federal estate taxes the state of Indiana does not have its own inheritance or estate taxes. The tax rate is based on the relationship of the inheritor to the deceased person. Tax Foundation analyst Katherine Loughead noted The top marginal estate tax rate under this proposal would become the highest in the country at 21.

However other states inheritance laws may apply to you if. Even though there is a state tax assessment there is no inheritance tax estate tax or gift tax. However you may have to pay income tax if you inherit an IRAannuity etc which includes the decedents pre-tax dollars.

Below we detail how the estate of Indiana will handle your estate if theres a valid will as well as who is entitled to your property if you have an invalid will or none at all. The federal estate and gift tax exemption has been increased from 5000000 in 2017 to 10000000 in. People often use the terms estate tax and inheritance tax interchangeably when in fact they are distinct types of taxation.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

State Death Tax Is A Killer The Heritage Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

Maryland To Cut Estate Tax As Blue States Fall In Line

State Estate And Inheritance Taxes Itep

State Estate And Inheritance Taxes Itep

Washington Has The Nation S Highest Estate Tax Most States Have Gotten Rid Of The Tax Opportunity Washington

State Estate And Inheritance Taxes

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

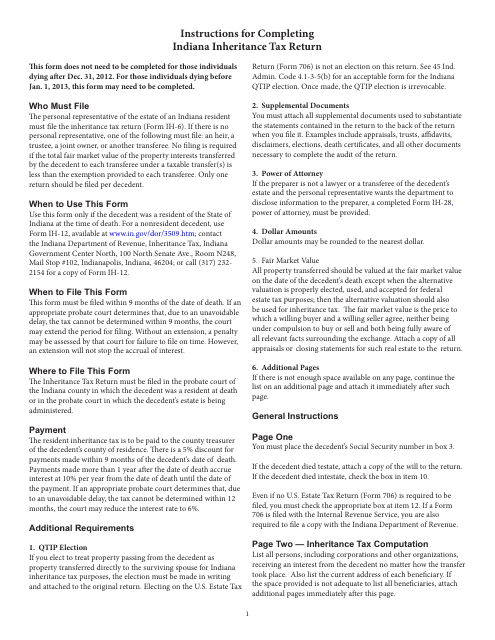

Download Instructions For Form Ih 6 Indiana Inheritance Tax Return Pdf Templateroller